Market Report

Spring Market Report: Property Insights

10 September 2025

by Sally O'Connell, Chief Executive Officer

AUSTRALIA’S ECONOMY & HOUSING:

FIRMING WITH CAUTIOUS OPTIMISM

by Sally O’Connell, Chief Executive Officer

After two increasingly tough years for households, the macro picture is finally starting to ease, however most consumers are yet to see any positive impact at the ‘hip pocket’. The RBA has been carefully threading the needle toward a soft landing, and all signs to date are this is on track – so far. We are, however, in a historically volatile world and caution remains in most sectors. Importantly, and positively, consumer sentiment is on the rise, with the August Westpac – Melbourne Institute survey up 5.7% in July to its highest reading since July 2022, off the back of the third rate cut in this cycle.

Inflation has cooled into the Reserve Bank’s target band of 2% – 3% and the cash rate has continued on its downward trajectory. However, the RBA cycle descriptor of “easier” doesn’t mean “easy”. Growth is still soft, unemployment has edged up from the lows, and the supply side of housing remains constrained. The net effect is an economy that is stabilising from a slower base and a housing market that’s firming, particularly where demand is deepest and supply tightest. Risks however abound.

NATIONAL PRICE GROWTH

Residential property values continue to gain momentum as we move into Spring. Annualised national quarterly growth now sits at 7.2%, ahead of the backward looking 3.7% annual rate. The trend is clearly stronger. This will continue with any further interest rate cuts that may emerge as we move through the easing cycle.

• Hobart 0.4% (still 10.4% below March 2022 peak)

Darwin heads the list at 22.4%, with Perth and Brisbane next being 10.4% and 9.2% respectively. Melbourne is ahead only of Hobart, with an annualised increase of 4.8%, however a vast improvement on the last twelve months being just 0.5%. Directionally, we are seeing evidence of this market on the improve.

At the First Homebuyer level, the Federal Governments 5% deposit scheme will increase demand. This is exacerbated by the announcement to bring this forward from January 2026 to 1 October 2025. It is important to remember that this doesn’t automatically increase capacity. Borrowers still need to evidence serviceability to lenders. It will however have an impact. This is likely to buttress prices in the newly increased state-based price bands, and have a knock on effect on price bands one to two levels higher. Expect a flurry of activity across FHB markets nationally. Whether this demand focused scheme simply increases the price and does little to improve affordability remains to be seen.

MELBOURNE SNAPSHOT: RESILIENCE WITH VALUE ON OFFER

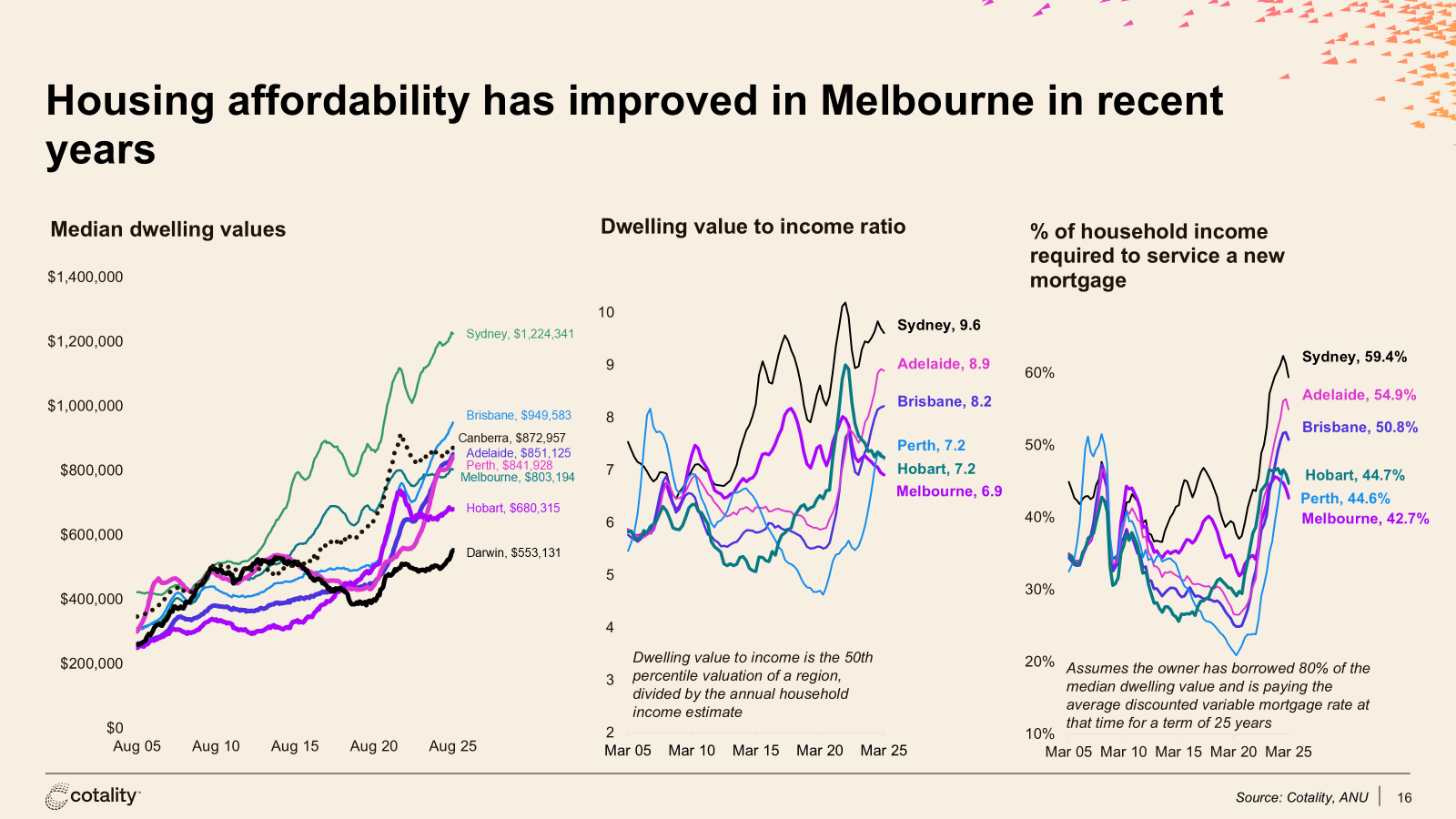

For metropolitan Melbourne, conditions have firmed slightly during winter. Cotality’s July read showed Melbourne up ~0.4% month-on-month, with annual growth nudging back into the black after a softer patch last year. That’s not a boom, and it won’t be. It’s a steady rebuild. Compared with Brisbane, Adelaide and Perth (already at record highs), Melbourne still offers relative value on most metrics, a point not lost on upgraders and returning migrants, with prices still 3.4% below the high of March 2022.

– Vendors increasingly pragmatic on price guides early in a campaign, then willing to hold the line once genuine competition materialises late.

The takeaway: Melbourne is in the “value rotation” phase of the cycle, quality, well-located homes sell well; secondary property needs requires sharper pricing to attract interest; townhouses and downsizer-friendly format residences remain tightly held. With circa 98,000 net new residents added to Victoria in the past year and a further 100,000 to 130,000 expected annually for the next five years, the demand backdrop is as strong as ever.

LISTINGS & MARKET DEPTH: A LEANER LANDSCAPE

RENTAL MARKETS: TIGHT & PRESSURE TO RESUME

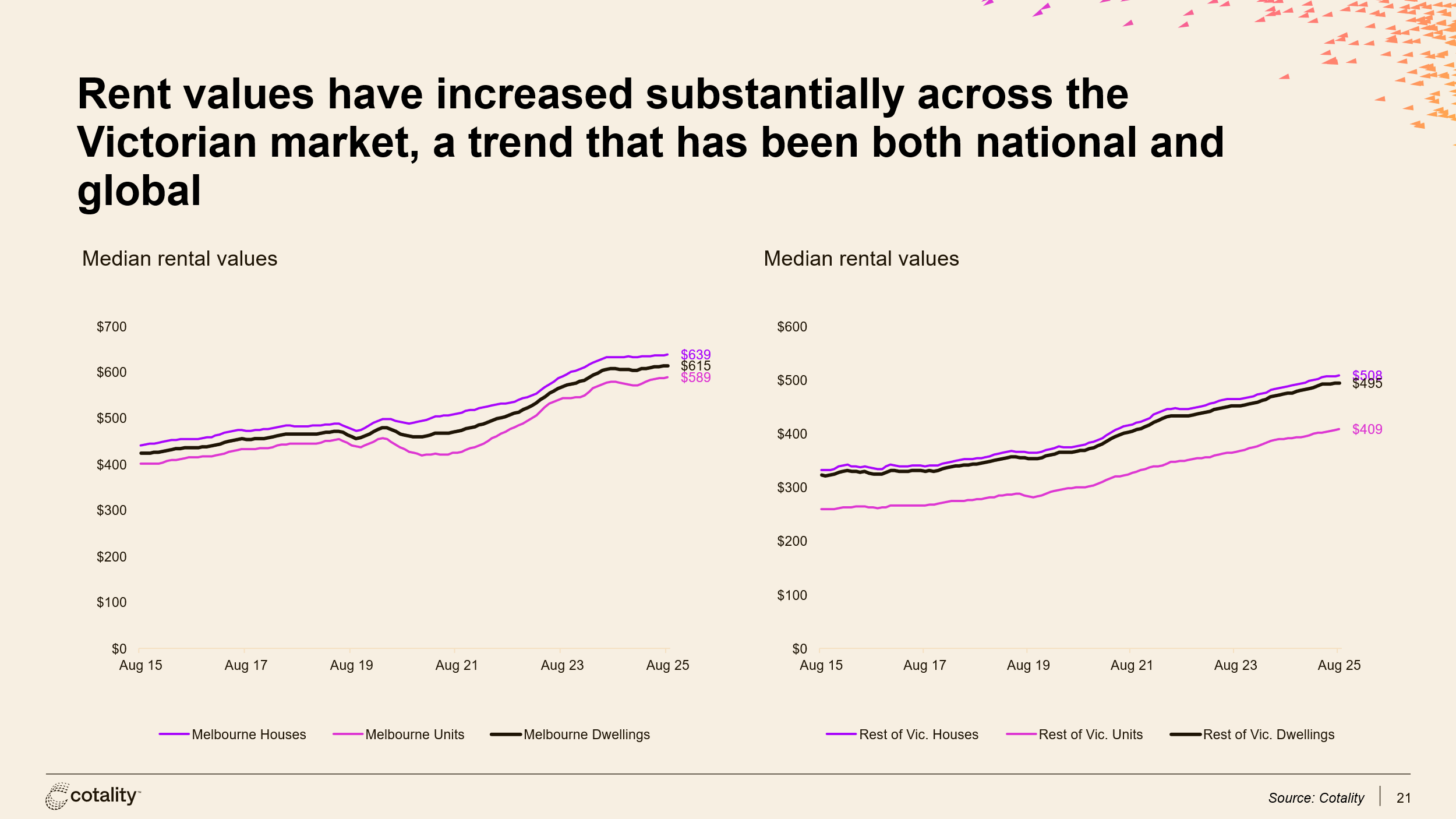

Nationally, rents have increased 3.7% over the past year. Capital cities have varied with Darwin leading at 7.3% and Melbourne delivering the lowest increase of just 1.1%

Rents surged sharply through 2023–24 in Melbourne PropTrack reports an annual average increase of nearly $8,600 a year (about 10.6%) as of mid‑2024. However the annual increase to July 2025 has cooled significantly. Whilst good news for renters, yields have moderated depressing investor demand until recently. The population outlook combined with an interest rate cutting cycle suggest upward pressure on rents and increased investor interest throughout both metropolitan and regional Victorian markets in the coming year.

RATES & INFLATION: DOWN, CAREFULLY & DELIBERATELY

The RBA has reduced the cash rate again in August, taking it to 3.60% and reinforcing the fact that inflation is moderating toward the midpoint of its 2–3% target. The Board also signaled it will keep moving carefully, with an easing bias, however only after careful analysis of the data and risks. We expect two 25bps cuts for the remainder of the year, at a maximum. It may be just one. The very latest uptick in inflation is driven largely by a roll off in electricity subsidies, so whilst yes inflationary, that rate of change will not sustain.

Although the USA tariffs will be inflationary for the US economy, the opposite impact will result for the rest of the world. As global suppliers are dissuaded from exporting to the US market, they will redirect supply to other countries, including Australia. The increase in supply will exert disinflationary pressure into the Australian economy, good news for importers and consumers.

GROWTH & JOBS: SOFT WITH A DOWNSIDE RISK

Our GDP growth outlook is weak at 1.7% to December, and 2% for both 2026 and 2027. Unfortunately, the slowdown in the Chinese property sector is challenging for our resources sector, a prime driver of much growth over the prior decade. The ‘China growth story’ will not be here to support us this time, adding to the belief that in the absence of productivity improvement, the growth outlook in Australia is benign.

On jobs, the national unemployment rate rose through the June quarter and then eased to 4.2% in July as participation hit new highs. The RBA expects unemployment to stabilise slightly above 4% over the next couple of years. These are encouraging numbers however risks are the government sector providing over 80% of new jobs in the past two years being impossible to sustain (especially as the deficit pressures increase) and the risk of joblessness increases from AI.

POPULATION & SUPPLY: SUPPLY & DEMAND IMBALANCE FOR LONGER

Looking forward, the Centre for Population projections (used in the 2025–26 Federal Budget) have Victoria’s population lifting by some 100,000, 130,000 people per year for the next five years, reaching 7.54 million by 2029.

As rates fall slowly, population keeps increasing and supply of new homes lags, upward price pressure continues, with rents leading and established, well-located homes seeing the firmest demand. For Melbourne in particular, exacerbated by very poor price performance over recent years, the outlook is for a sustained price recovery in coming periods.

WHAT THIS MEANS FOR ABERCROMBYS CLIENTS

Sellers:

– The best-in-class homes are selling well with competitive bidding. Presentation and campaign strategy matter: buyers are paying a premium for turnkey, not potential.

– With rates easing gradually, buyer capacity is improving quarter by quarter. If you are considering a Spring campaign, early preparation (styling, pre-sale works, documentation) pays off in bidder depth.

– Pricing should recognise the stronger tone but remain anchored to recent, like-for-like results. Momentum is positive, but buyers are disciplined.

– The window to secure quality stock before financing conditions loosen further is open now. Expect more competition into late spring if another RBA cut looks likely.

– Focus on fundamentals – walkability, schools, transport, aspect, build quality. In this phase of the cycle, those attributes defend value best.

Investors:

– Rents and yields are likely to increase in the near term due to demand and supply imbalance.

– Target assets with enduring tenant appeal (light, quiet, storage, parking) near rail and universities. Vacancy risk is low in those pockets, and the immigration pulse supports occupancy.